Responses to the April Nonmanufacturing Business Outlook Survey suggest continued expansion in nonmanufacturing activity in the region. The indexes for general activity at the firm level, sales/revenues, and new orders all declined but remained positive. Prices for the firms' inputs and own goods sustained overall increases, according to the prices paid and prices received indexes. The respondents continued to anticipate growth over the next six months.

Current Indexes Remain Positive

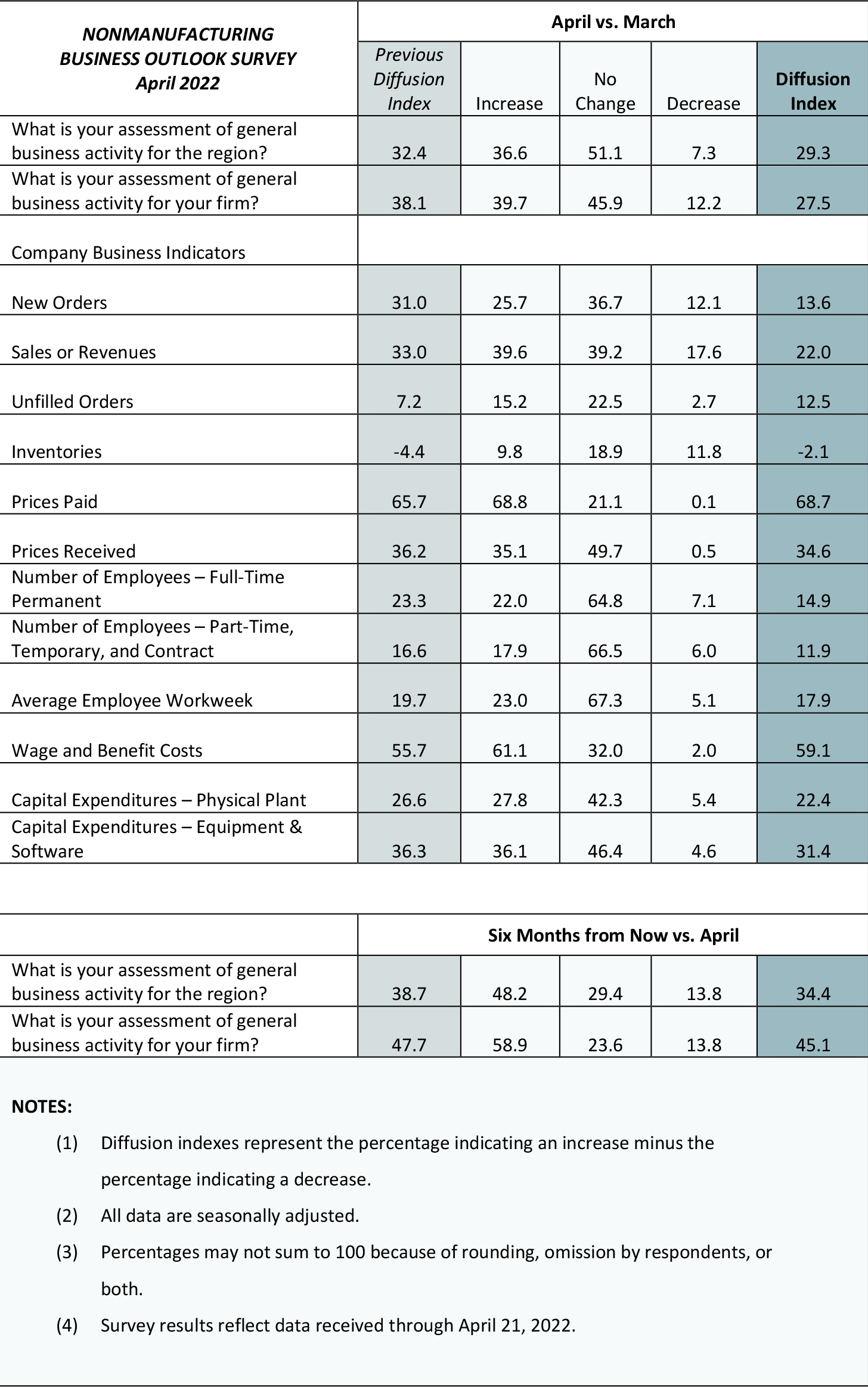

The diffusion index for current general activity at the firm level declined from a reading of 38.1 in March to 27.5 this month (see Chart 1). Nearly 46 percent of the responding firms reported no change in general activity (up from 28 percent last month), while 40 percent of the firms reported increases (down from 51 percent) and 12 percent reported decreases (little changed from last month). The index for sales/revenues fell from a reading of 33.0 to 22.0 this month, and the new orders index fell 17 points to 13.6. Almost 26 percent of the firms reported increases in new orders (down from 41 percent last month), 37 percent reported no change (up from 25 percent), and 12 percent reported decreases (up slightly from 10 percent). The regional activity index fell 3 points to 29.3.

Most Firms Report Steady Employment

The full-time employment index fell 8 points to 14.9 in April. Nearly 65 percent of the firms reported steady full-time employment levels, while the share of firms reporting increases this month (22 percent) exceeded the share reporting decreases (7 percent). The part-time employment index decreased 5 points to 11.9, and the average workweek index edged down 2 points to 17.9.

Respondents Continue to Report Overall Price Increases

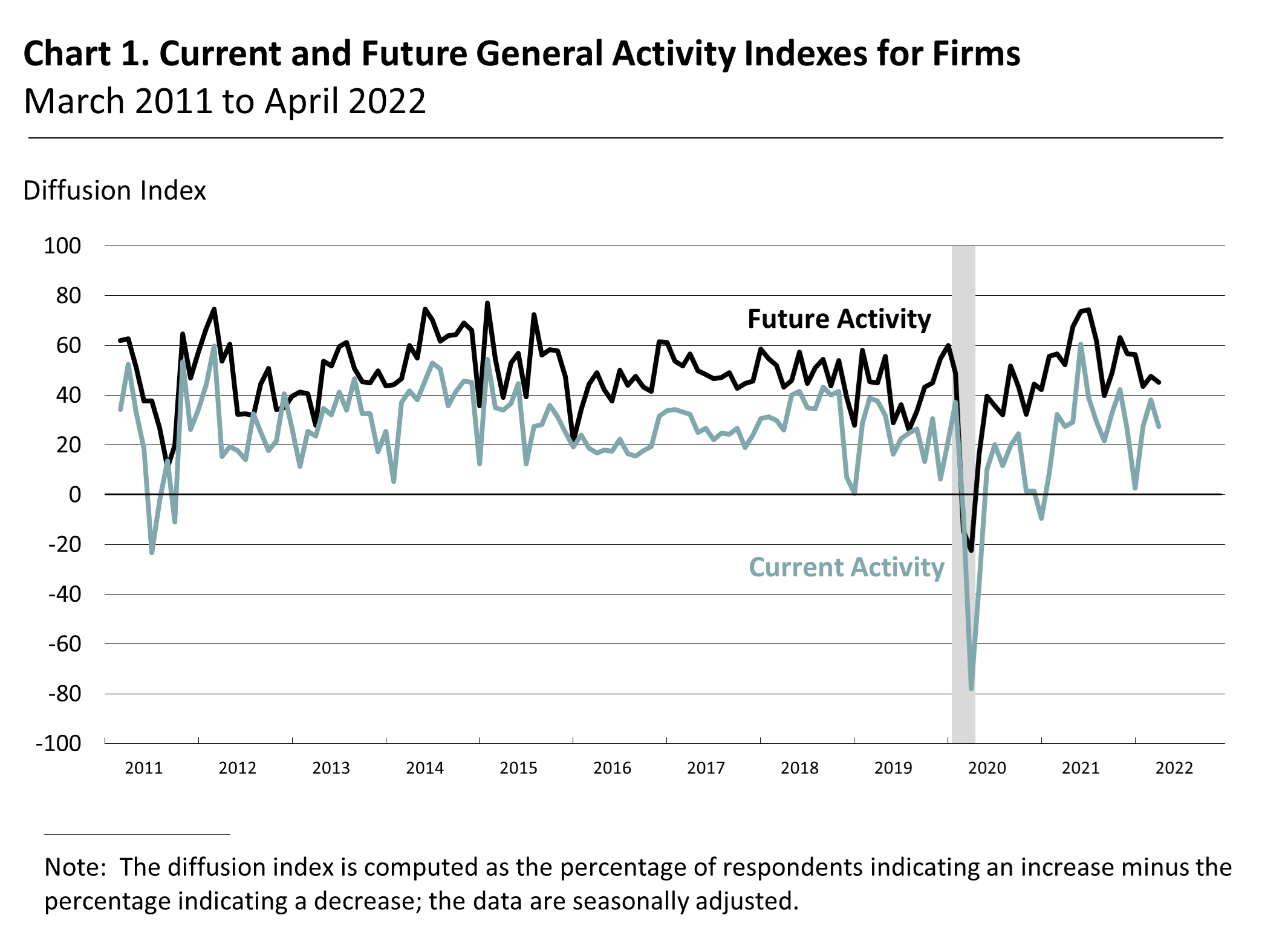

The prices paid index rose 3 points to 68.7, a reading in line with its historical high set back in February (see Chart 2). Nearly 69 percent of the respondents reported increases in their input prices, while none reported decreases. More than 21 percent of the respondents reported stable input prices. Regarding prices for the firms' own goods and services, the prices received index decreased from a reading of 36.2 in March to 34.6 in April. The share of firms reporting increases in prices received (35 percent) exceeded the share reporting decreases (1 percent). Half of the firms reported steady prices for their own goods and services.

Firms Expect Largest Cost Increases in Energy, Raw Materials

In this month's special questions, the firms were asked about changes in wages and compensation over the past three months as well as their expected changes to various input and labor costs for 2022. Nearly 70 percent of the firms indicated wages and compensation costs had increased over the past three months, 30 percent reported no change, and none reported decreases. Most firms reported adjusting their 2022 budgets for wages and compensation since the beginning of the year, with 44 percent indicating they are planning to increase wages and compensation by more than originally planned and 29 percent of the firms indicating they are planning to increase wages and compensation sooner than originally planned.

The firms still expect higher costs across all categories of expenses in 2022: Responses indicate a median expected increase of 5 to 7.5 percent for energy and for other raw materials, higher than when this question was asked back in January. The median expected changes for wages, health benefits, and total compensation (wages plus benefits) were unchanged at 4 to 5 percent.

Firms Continue to Anticipate Growth

Both future activity indexes declined but continue to suggest that firms anticipate growth over the next six months. The diffusion index for future activity at the firm level edged down from a reading of 47.7 in March to 45.1 this month (see Chart 1). Nearly 59 percent of the respondents expect an increase in activity at their firms over the next six months, compared with 14 percent that expect decreases and 24 percent that expect no change. The future regional activity index decreased 4 points to 34.4.

Summary

Responses to this month's Nonmanufacturing Business Outlook Survey suggest continued expansion in nonmanufacturing activity in the region. The indicators for firm-level general activity, new orders, and sales/revenues all declined but remain positive. Additionally, the firms continue to report overall increases in prices and employment. The respondents continue to expect growth over the next six months.

Special Questions (April 2022)

1. How have wages and compensation changed at your firm over the past three months?

|

Percent (%) |

| Increased |

69.7 |

| No change |

30.3 |

| Decreased |

0.0 |

2. Since the beginning of the year, have you adjusted your budget for wages and compensation for 2022?*

|

Percent (%) |

| Yes, and we are planning to increase wages and compensation by more than originally planned. |

43.8 |

| Yes, and we are planning to increase wages and compensation sooner than originally planned. |

28.8 |

| No, we have not needed to make adjustments. |

35.0 |

| Other |

1.3 |

| *Percentages do not sum to 100 because more than one option could be selected. |

3. What percentage change in costs do you now expect for the following categories over all of 2022?**

| |

Energy

(%)

|

Other Raw Materials

(%)

|

Intermediate Goods

(%)

|

Wages

(%)

|

Health Benefits

(%)

|

Nonhealth Benefits

(%)

|

Wages + Health Benefits + Nonhealth Benefits (%) |

|

Decline of more than 1%

|

3.0 |

0.0 |

0.0 |

1.4 |

0.0 |

0.0 |

4.5 |

|

No change

|

7.5 |

11.1 |

20.5 |

9.9 |

22.7 |

34.5 |

7.6 |

|

Increase of 1–2%

|

9.0 |

6.7 |

5.1 |

4.2 |

4.5 |

10.3 |

1.5 |

|

Increase of 2–3%

|

6.0 |

6.7 |

5.1 |

14.1 |

7.6 |

6.9 |

3.0 |

|

Increase of 3–4%

|

4.5 |

6.7 |

2.6 |

14.1 |

6.1 |

19.0 |

15.2 |

|

Increase of 4–5%

|

16.4 |

15.6 |

20.5 |

21.1 |

10.6 |

12.1 |

18.2 |

|

Increase of 5–7.5%

|

10.4 |

11.1 |

15.4 |

19.7 |

18.2 |

8.6 |

21.2 |

|

Increase of 7.5–10%

|

11.9 |

6.7 |

7.7 |

4.2 |

10.6 |

3.4 |

12.1 |

|

Increase of 10–12.5%

|

14.9 |

17.8 |

10.3 |

5.6 |

9.1 |

0.0 |

6.1 |

|

Increase of more than 12.5%

|

3.0 |

2.2 |

0.0 |

1.4 |

3.0 |

1.7 |

4.5 |

|

Median Expected Change |

5–7.5% |

5–7.5% |

4–5% |

4–5% |

4–5% |

2–3% |

4–5% |

|

Median Expected Change (January) |

4–5% |

4–5% |

4–5% |

4–5% |

4–5% |

2–3% |

4–5% |

| **The firms responded to more detailed changes than shown in the provided ranges. |

Summary of Returns (April 2022)