Manufacturing activity in the region continued to grow, according to the firms responding to the August Manufacturing Business Outlook Survey. The survey's current indicators for general activity and shipments declined from July's readings but remained elevated, while the new orders indicator rose. Additionally, employment increases were more widespread this month, and both price indexes remained elevated. Most future indexes moderated this month but continue to indicate that the firms expect growth over the next six months.

Current Indicators Remain Positive

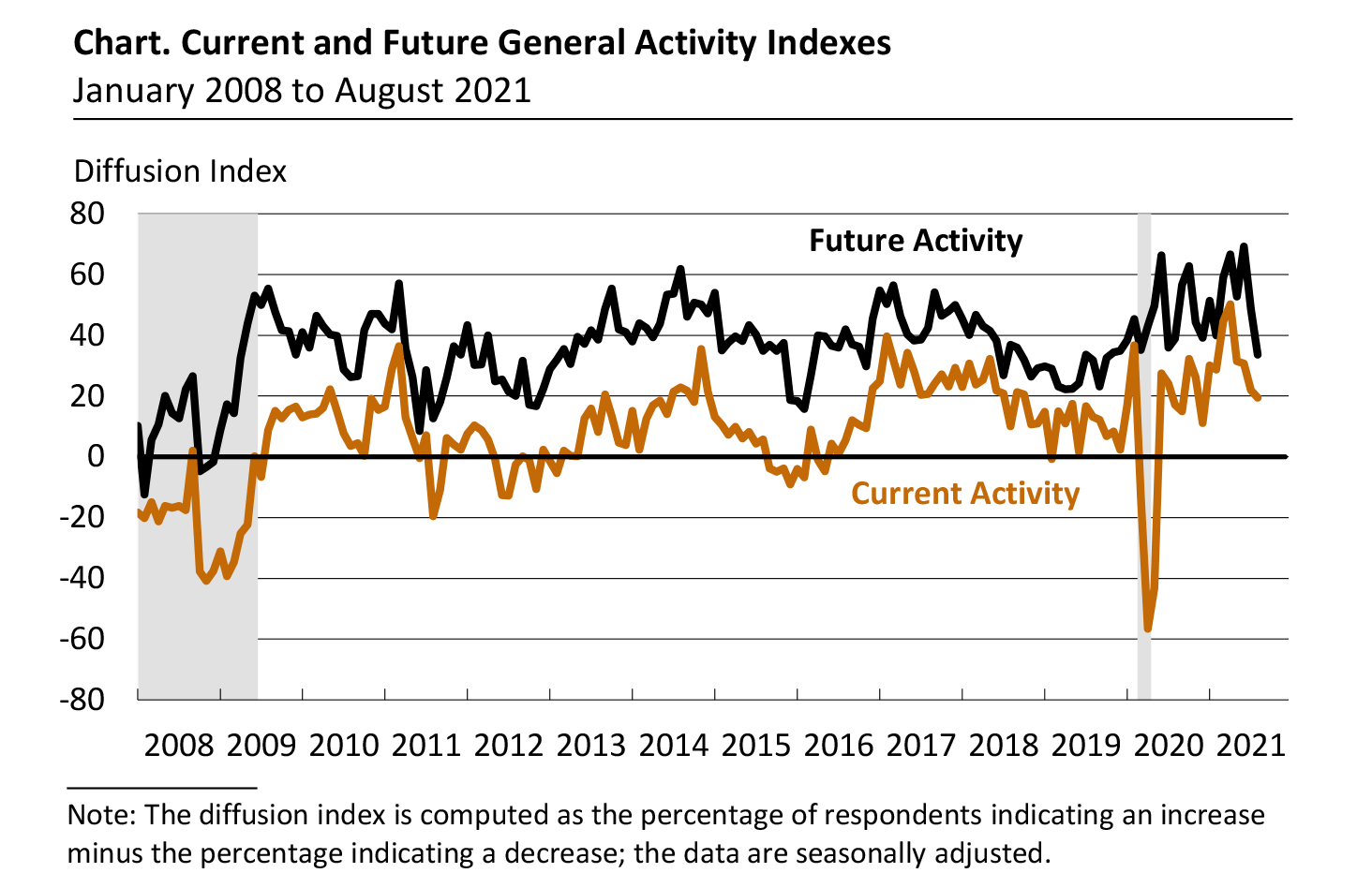

The diffusion index for current activity decreased 3 points to 19.4 in August, its fourth consecutive decline after reaching a long-term high reading in April (see Chart). Twenty-eight percent of the firms reported increases in current activity this month, while 9 percent reported decreases. The index for new orders increased 6 points to a reading of 22.8, while the current shipments index fell 6 points to 18.9 in August. Nearly 34 percent of the firms reported increases in shipments this month, exceeding the 15 percent that reported decreases.

On balance, the firms reported increases in manufacturing employment, and the current employment index increased 3 points to 32.6. Over 39 percent of the firms reported higher employment, 7 percent reported lower employment, and 54 percent reported no change. The average workweek index rose 6 points to 24.5.

Price Indexes Remain Elevated

The firms continued to report increases in prices for inputs and their own goods. The prices paid diffusion index edged up 2 points to 71.2, after falling 10 points last month from June's 42-year high. Nearly 74 percent of the firms reported increases in input prices, while 3 percent reported decreases. The current prices received index increased 7 points to 53.9, its highest reading since May 1974. Over 56 percent of the firms reported increases in prices of their own manufactured goods, up from 50 percent in July; 40 percent of the firms reported stable output prices.

Firms Expect Own Price Increases to Match Inflation Rate

In this month's special questions, the firms were asked to forecast the changes in the prices of their own products and for U.S. consumers over the next four quarters. Regarding their own prices, the firms' median forecast was for an increase of 5.0 percent, the same as when the question was last asked in May. The firms' actual price change over the past year was 3.0 percent. The firms expect their employee compensation costs (wages plus benefits on a per employee basis) to rise 4.0 percent over the next four quarters, the same as in May. When asked about the rate of inflation for U.S. consumers over the next year, the firms' median forecast was 5.0 percent, an increase from 4.0 percent in May. The firms' median forecast for the long-run (10-year average) inflation rate was 3.0 percent, the same as in May.

Firms' Outlook Softens, but Continued Growth Is Expected

The respondents continue to expect growth over the next six months, although most of the survey's future indexes declined. The diffusion index for future general activity decreased 15 points to 33.7 in August, its second consecutive decline after reaching a 30-year high in June. Nearly 46 percent of the firms expect growth over the next six months, down from 59 percent last month; 12 percent expect a decrease in activity. The future new orders index decreased 7 points to 38.0, and the future shipments index fell 25 points to 40.8 this month. The future employment index remained elevated but fell 14 points to 42.7. Over 48 percent of the firms expect to increase employment in their manufacturing plants over the next six months, compared with only 6 percent that anticipate employment declines.

Summary

Responses to the August Manufacturing Business Outlook Survey suggest continued expansion for the region's manufacturing sector. The indicators for current activity and shipments decreased from last month but remained elevated. Additionally, the firms reported increases in new orders and employment. The survey's future indexes moderated this month but continue to suggest expected growth over the next six months.

Special Questions (August 2021)

|

Please list the annual percent change with respect to the following: |

|

Current

|

Previous

(May 2021)

|

|

For your firm:

|

|

Forecast for next year (2021Q3–2022Q3)

|

|

1. Prices your firm will receive (for its own goods and services sold).

|

5.0

|

5.0 |

|

2. Compensation your firm will pay per employee (for wages and benefits).

|

4.0

|

4.0 |

|

Last year's price change (2020Q3–2021Q3)

|

|

3. Prices your firm did receive (for its own goods and services sold) over the last year.

|

3.0 |

2.3 |

|

For U.S. consumers:

|

|

4. Prices U.S. consumers will pay for goods and services over the next year.

|

5.0

|

4.0

|

|

5. Prices U.S. consumers will pay for goods and services over the next 10 years (2021–2030).

|

3.0 |

3.0 |

|

The numbers represent medians of the individual forecasts (percent changes). For question 5, firms reported a 10-year annual-average change.

|